Connected Cars Are Industry Stars

In the automotive industry, “connected cars” are everywhere. Whether referred to in a literal or proverbial sense, connected cars or software-defined vehicles represent a promising next chapter for the automotive industry. From LinkedIn posts and podcasts to entire conferences, connected cars are becoming the sun around which our automotive world revolves.

While consumers may not understand the jargon, quirks, and idiosyncrasies of the automotive industry, their interests are piqued once they have a basic definition of a connected car and its potential benefits. However, that interest may only extend so far, as consumers view certain features and capabilities of a connected car as more valuable than others.

These and other realizations are among the key findings in a body of research from Salesforce in partnership with YouGov, released in January 2024, that surveyed nearly 2,200 U.S. drivers aged 18 and over. Most participants (92 percent) owned their vehicles instead of leasing, although almost half said they plan to get a new car in the next two years. In the Salesforce study, participants revealed they were willing to pay more for certain features and trade their personal data if it means slicing the overall cost of vehicle ownership.

“With data from connected cars, OEMs have an incredible opportunity to make better, safer, smarter, and more sustainable cars while opening up new revenue streams,” said Achyut Jajoo, Senior Vice President and General Manager of Manufacturing and Automotive at Salesforce. “Those who can harness this data will be able to differentiate themselves and their brand, build the best vehicles, and give drivers the best experiences.”

By The Numbers

Salesforce began its survey by talking with participants about connected cars in a general sense. Perhaps not surprisingly, 65 percent said they didn’t know what a connected car was, while 37 percent had never heard the term. Once given a definition of a connected car, nearly half (48 percent) believed they currently drove one.

Several key findings arose at this point in the survey. When asked what features were most important for their next vehicle, participants listed some time-tested attributes that all buyers care about, whether that car is “connected” or not. In the Salesforce study, 68 percent said price was the most important factor, followed by reliability (59 percent) and safety (37 percent).

Vehicle size, style, and brand ranked lower in importance. Barely 30 percent deemed size a top three must-have feature for their next vehicle purchase, while less than 25 percent cited brand loyalty and style as primary motivating factors. Even though carbon-neutrality efforts are a core area of focus for automakers, only nine percent said sustainability and environmental impact were in their top three considerations when purchasing their next vehicle.

Although this Salesforce study focused on connected cars and not sustainability, this brief nugget of information is still worth noting, as other bodies of research show how sustainability, along with trust and transparency, will serve as non-negotiables for brands that wish to engage future generations.

“Sustainability is becoming a differentiator in competition,” said Benjamin Krieger, Secretary General of CLEPA, the European Association of Automotive Suppliers, during an appearance on AutoVision News Radio. “Companies need to be excellent not only on the technology side but also be sustainable, where the impact, environmentally and socially, is minimized as much as possible.”

Apple CarPlay & Android Auto Usage

Apple CarPlay and Android Auto, despite widespread availability on nearly every make and model today (some even wireless), didn’t ping the scales as much as conventional logic might suggest. In the Salesforce study, 62 percent said they either don’t have or are not using Apple CarPlay and Android Auto. The exact numbers break down like so:

- 11 Percent: “I have them but don’t use them.”

- 42 Percent: “I don’t have either.”

- Nine Percent: “Not sure if I have Apple CarPlay or Android Auto.”

The findings on Apple CarPlay and Android Auto might be somewhat explained by how the average age of vehicles in operation in the United States is at a historic high of 12.5 years, as detailed by S&P Global. On the other side of the coin, it’s still surprising, given how many of us in the industry might classify connectivity features like Apple CarPlay and Android Auto as universal and ubiquitous.

“How are you not using Android Auto, and you work in Detroit where they design cars? You’re missing out because it’s a convenient feature,” my best friend, Bryan Volz, told me during my visit to see him in Omaha, Nebraska, over Thanksgiving. As any good friend of two decades would do, Bryan was a groomsman at my wedding and still makes fun of me for liking Coldplay.

“I can quickly call the boys (his sons call me “Uncle Carl”) and run my Google maps for anywhere I need to go, but want to avoid slowdowns,” Bryan said, showing me how he uses wired Android Auto daily in his late-model Hyundai. “If you used it in your own Hyundai, you could listen to Coldplay or whatever corny bands you like these days.”

In the Salesforce study, only a handful were like my best friend, as just 31 percent identified Apple CarPlay or Android Auto as a top-three must-have feature for their next vehicle. An even smaller number (26 percent) said they would be willing to pay more for Apple CarPlay or Android Auto.

“This could be a great opportunity for OEMs to create their own branded experiences in lieu of CarPlay or Android Auto,” Jajoo said, adding how the data generated by connected cars is as valuable as gold or oil for brands looking to create a more personalized experience inside the vehicle. “It’s a gold rush – pun intended – for the industry, but it’s also an incredible time to be a car owner.”

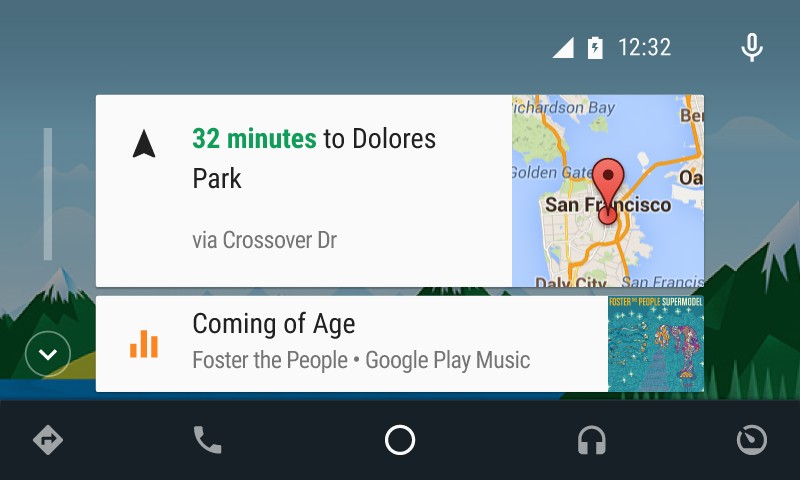

In May 2015, Hyundai became the first OEM to launch Android Auto in its production vehicles, starting with the 2015 Sonata with Navigation. Drivers needed the Android 5.0 “Lollipop” operating system and the Android Auto companion app in order for the feature to pair with the Sonata. “The Google Now card-based experience provides suggested locations and travel times based on the user’s searches, calendar entries and home and office locations, as well as weather information and ‘now playing’ information for music streamed via the phone,” Hyundai wrote in its press release at the time.

Will Consumers Trade Personal Data?

Connected cars are forecasted to make up 95 percent of all vehicles on the road by 2030, with each one generating an estimated 25 gigabytes of data per hour – as much data as it would take someone to stream nearly 600 hours of music (Coldplay in my case). As Jajoo stated, how this data may be leveraged for new revenue channels through value-added features is a prime area of focus for the automotive industry.

For example, in the Salesforce survey, 43 percent said they would trade personal data for more comprehensive personalization options, including unique driver profiles that go further than what is currently available with respect to tailoring every aspect of the vehicle to their liking.

“Automakers are even using interior lighting as a way to differentiate their products,” writes Chet Babla, Senior Vice President of Strategic Marketing for indie Semiconductor, in his analysis for AutoVision News on the automotive megatrends of 2024. “Owners have the ability to adjust the in-vehicle ambiance to match their style preferences, the mood of the occupants, or the context of the journey.”

Over half (54 percent) said they feel comfortable with their car collecting diagnostic data in general, with 36 percent saying they are okay going farther and trading personal data for features like real-time vehicle health updates. Meanwhile, 43 percent said they would consider paying more for better drive-assist features. This may corroborate the study’s initial findings that car buyers prioritize safety when shopping for a new vehicle.

Although the numbers were smaller, some in the Salesforce study said they would pay more for touchscreen controls (33 percent), Wi-Fi connectivity (30 percent), and over-the-air updates (21 percent). Gaming, video, and in-vehicle apps had the lowest interest, with just 17 percent saying they would pay more for such features.

By contrast, a majority (67 percent) indicated they would trade personal data if it meant potential savings on vehicle ownership costs, such as lower insurance premiums. However, 63 percent said opting in was necessary and that OEMs should refrain from unmitigated data collection.

“Automakers are going to have to start being more transparent about how and why this type of data is being collected, how it is being stored, and ultimately, how its collection benefits the end user,” Jajoo explained. “By doing so, and by doing things like letting them opt-in to collection, drivers will feel more comfortable sharing this type of information.”

Future Considerations

During the 2023 edition of Reuters Automotive USA at the Huntington Place in downtown Detroit, software-defined cars and the subsequent in-vehicle experience were discussed at length on the Automotive Tech Stage (this topic will appear on the agenda again for Reuters Automotive Europe in May 2024). Between the expert-led panel discussions and fireside chats, a few key patterns emerged:

- Automakers can leverage the data collected by software-defined cars to enable more personalized experiences and services via subscription. This creates new revenue channels after the initial sale. If the execution of and communication around these services is exceptional, OEMs will have more meaningful customer relationships.

- Automakers have the potential to drop the ball, either by not being fully transparent about data collection or by pay walling certain features a customer would deem as “already coming with the cost of the car.”

- We have yet to fully determine the fine line between the features consumers will pay extra for and what they won’t. Along these same lines was the idea of subscription fatigue. If a certain percentage of the population looks at their vehicle as a place of respite, do we alienate them by overloading them with on-screen prompts?

This Salesforce study confirms the first point while shedding light on the other two.

“This is where technology like Salesforce’s Automotive Cloud will become increasingly important,” Jajoo said. “It helps automakers bring all of their connected car data together with their customer data in one place to power the next generation of in-cabin experiences that are personalized for every driver.”

A summary infographic of the Salesforce study, Connected Cars and the Data Exchange, is available here.